Bing Ads will serve all Yahoo search ads in new Microsoft-Verizon Media deal

Microsoft and Verizon announced Thursday an update to the partnership that has long existed in various iterations between Yahoo, AOL and Bing search ad networks.

Verizon-owned Yahoo and AOL are under the umbrella of Verizon Media Group, formerly known as Oath. Microsoft and Yahoo have had a long, somewhat convoluted and sometimes strainedpartnership that traces back to 2009.

What is changing? Microsoft’s Bing Ads will be the exclusive search adverting platform for Verizon Media properties, including Yahoo and AOL.

When Microsoft and the then-independent Yahoo last renegotiated their search advertising partnership in April 2015, Yahoo was looking to build up its new Gemini platform and retained the right to serve up to 49 percent of search ads on its properties through Gemini or other partners (like the three-year deal it struck with Google in the fall of 2015), with the other 51 percent flowing through Bing Ads. Now, the new arrangement cedes all search ad serving to Bing Ads — and eliminates any share of Yahoo search inventory Google may have had. This includes inventory on Aol.com, Yahoo.com, AOL Mail, Yahoo Mail, Huffington Post, TechCrunch and other Verizon-owned properties.

The arrangement also affects native advertising. Microsoft is introducing new placements on MSN. Oath Ad Platforms’ (what was Gemini) Native Marketplace will have exclusive third-party access to the new native ad inventory on MSN. The Microsoft Audience Network for native ads will gain access to inventory on Verizon Media properties as well as new MSN placements called End of Article Block and Gallery Interstitial. Native ad performance from Verizon Media properties will be reported in the Bing Ads UI as syndication traffic.

Yes, AOL is still around. Bing Ads took over the AOL search business from Google in 2015, and will continue to serve organic results and ads on the network.

Why should you care? For search ad buyers, the updated partnership means that they can reach audiences across Yahoo through one platform. Microsoft said it estimates the unified buying could lead to an increase in clicks of 10 to 15 percent in the U.S.

“While exact results will vary by client, Bing Ads users should closely monitor their budgets to ensure they are ready to capture these potential increases in click volume,” said Kya Sainsbury-Carter, VP of global partner service for ad sales at Microsoft, in a statement.

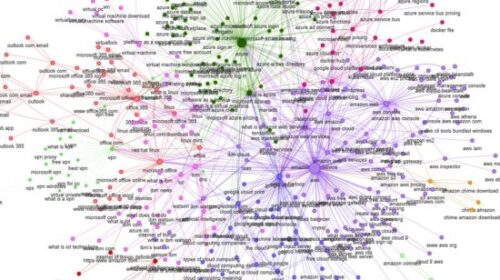

In addition to potentially greater click volume, Microsoft highlights its audience targeting and optimization capabilities powered by the Microsoft Graph, which includes LinkedIn data, and Microsoft AI.

The companies expect to complete the transition worldwide by the end of March.

How to manage the transition. Advertisers that are currently running campaigns on Oath Ad Platforms should continue to do so through the transition to avoid losing traffic. In the meantime, Microsoft recommends running parallel campaigns in Bing Ads to absorb the traffic and ad spend shifts.